The CQ | WTF Summit Recap & The Economy's Goldilocks Moment

Plus the Forerunner Team's Must Reads of the Week

The CQ is Forerunner’s weekly newsletter rounding up the most pressing consumer news and analysis, plus some bonus musings from our investment team. Subscribe now to get the latest edition in your inbox every weekend.

By Forerunner | @ForerunnerVC

Earlier this week, Kirsten Green spoke at The Information’s WTF Summit on the state of the consumer, the state of the venture industry, and what’s happening with the exit market at large. Some highlights from her talk:

To understand the state of the exit market, we first have to understand the state of funding. For early-stage (seed and series A), we’re at about half the volume of 2021-2022, putting us right around where we were in 2019. That’s about right — 2019 was a pretty great time. But in this current moment, company quality seems to be higher than it was in 2019, since there is more pressure on companies to be stringent about unit economics and focus on durable growth.

In terms of valuations, we’re back at where we were around 2020, with AI deals fetching an approximate ~20-25% premium. So while deal volume is at 2019 levels, the prices are slightly higher.

The past few years have no doubt seen a sluggish IPO and M&A market. We’ve had a pandemic, historic inflation, higher-for-long rates, economic and global turmoil, and now a coming election. The result is that the mature growth companies standing are mettle-tested. I think there is a very strong class of companies waiting in the wings, and we’ll start to see that translating to the exit market in the coming quarters.

And finally, with AI evolving at a breakneck pace, builders have the opportunity to truly (and finally) deliver on the opportunity in personalization (something that’s been talked about in Silicon Valley for over a decade, but that never really met the promise). Because at its core, gen AI is about effectively personalizing our digital worlds, offering up insights with more comprehensive context than any one person could have themselves and taking broad swaths of legwork off of our plates by effectively performing tasks on our behalf.

For more on Kirsten’s talk, see The Information’s recap.

What We’re Talking About on Slack:

Bloomberg offers its take on how to think about the surprising U.S. jobs data. One key point: “Too many think of the Fed as remaining overly data-dependent and/or targeting a specific outcome. Instead, its policy approach seems to be evolving away from that phase of being excessively ‘data-dependent’ and, therefore, essentially backward-looking, to adopting more of an insurance mindset that, rather than target a precise outcome, seeks more to reduce the probability of particularly damaging ones.”

How long can the U.S. economy’s ‘Goldilocks’ moment last? Though there may have been good news with the resolution of the port workers’ strike and a positive jobs report, there are still potential risks on the horizon. Rising wages, which increased by 4.0% year-over-year, might lead to heightened inflation concerns if job growth continues to exceed expectations. Some economists predict the Fed might limit rate cuts to two quarter-point reductions this year, especially if upcoming inflation data is strong. And then who knows what the outcome of the election might bring. “Investors should never overreact to a single month’s jobs report. The most likely scenario for the economy is still a soft landing, aided by a gradually easing Fed. But investors shouldn’t unbuckle their seat belts just yet.”

Meet the HENRYs: The six-figure earners who don’t feel rich. Even though nearly 15% of U.S. households make $200K or more a year, practically a record, HENRYs—as in, High Earner, Not Rich Yet—are discovering that the rising inflation affecting everything from houses to cars to their children’s education, not to mention a heap of school loan debt, means that money doesn’t go as far as it used to. “What they’re feeling is a version of what a lot of Americans at every income level face—making more money but not feeling like there’s a surplus. The essence of being a HENRY is feeling a gap between what you have and what you think you need to be comfortable.”

Carrying a credit card balance has gotten way more expensive, with average interest rates reaching 21.5% in May, the highest since 1994. Credit card balances have increased by 31% since 2021, now averaging around $6,300. And because of the new $8 cap on late fees, which is still tied up in court, banks like Capital One and Synchrony are busy raising rates further or introducing entirely new fees to offset potential revenue losses. The CFPB estimates that consumers dish out about $14 billion annually in late fees, and that number could drop by $10 billion if the cap is implemented.

Business of Fashion highlights the Gap comeback that’s actually working. Under Zac Posen, the company’s creative lead who has been in the role for seven months, the iconic brand is showing promising signs of revival. This year, Gap Inc. has reported two consecutive quarters of year-over-year sales growth. The brand’s collaborations with MadHappy and Doen are paying off, with a 73% boost year-on-year in influencer mentions in the two months following those launches.

Google’s AI search summaries officially have ads now. Think: a query about removing a stain will include cleaning tips as well as a recommended detergent under a “sponsored” header. Further evidence that Google’s search dominance is unwinding: Forecasts indicate that the platform will lose its majority share for the first time in decades—Google will hold a 48% share of U.S. search advertising revenue next year, while Amazon's share is expected to grow to nearly 25%, and further to 27% by 2026.

How does Gen Z define luxury? It has evolved from dupe culture to an appreciation for authentic luxury items, as they begin to acquire their first high-end products, notes Casey Lewis of the After School Substack. One way they are acquiring luxury goods is through the secondhand market like with resale site The RealReal. Scarcity—a nearly sold-out LoveShackFancy x Stanley Cup collab, for instance—is another way they are redefining what luxury means to them. “The rise of digital resale marketplaces, education on product quality, customer reviews across social and access to expert opinions online empower Gen Z to go deeper with their research on products and assess what’s worth the splurge.”

Have we reached peak human life span? Researchers examined data on life expectancy at birth collected between 1990 and 2019 from countries where people tend to live the longest, like Japan, France, and South Korea (and the U.S., though our life expectancy is lower). They discovered that average life expectancies increased during that time in all the locations (except Hong Kong), but the rates at which they rose slowed down. “The new research suggests that while modern medicine has helped more people regularly live to their 70s, 80s, and 90s, getting the average age up beyond that will prove difficult. For example, the scientists calculated that even if all deaths before the age of 50 were eliminated, average peak life expectancy would only rise by one year for women and one and a half years for men.”

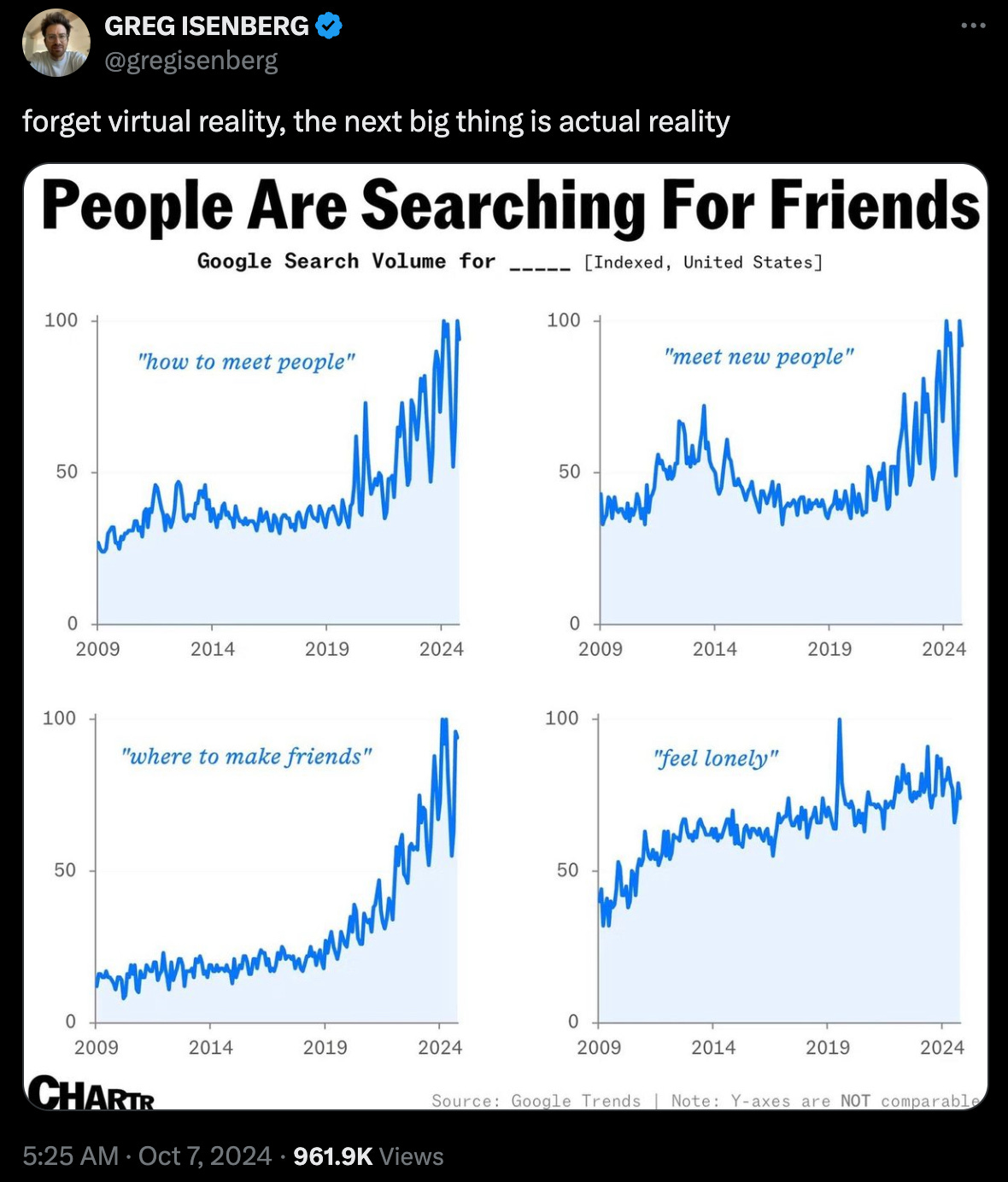

The New York Times takes a look at our nation of homebodies. A recent analysis of census data found that Americans are spending more time at home—mostly alone. From 2003 to 2022, time spent at home jumped by 10%—1 hour 39 minutes per day—with a significant rise in activities like work and religious practices occurring at home. For each extra hour at home, people spent an additional 7.4 minutes with family and 21 minutes alone, but 5 fewer minutes with friends. Those in the 15-to-34 age range have shown the largest increase in time spent at home, at about two hours more. While this shift was underway prior to Covid, the pandemic accelerated things.

Related:

Portfolio Highlights:

Pie’s innovative new take on the creator fund is profiled in The Information.

Glossier CEO Kyle Leahy visits Fast Company’s Most Innovative Companies podcast to discuss new launches and building a legacy brand.

KiwiCo co-founder Sandra Oh Lin visits the TechCrunch podcast Found to discuss how she turned STEM toys into big business.

Fora Co-founder Henley Vazquez stops by the Transform with Travel podcast to talk about changes in the travel industry, the rise of wellness travel, and more.

Fora Co-founder and Chief Product & Technical Officer Jake Peters discusses the future of the travel industry on the Travel Trends Podcast.

Portfolio Company Job of the Week:

Director of Growth Marketing at Atticus, the consumer-facing public interest law firm. Learn more about what makes Atticus so impactful and unique here.

There are ~730 other open roles at Forerunner portfolio companies, check ‘em out.