The CQ | Leland's Series A, Headway's Millionth Patient, Wonder's Acquisition of GrubHub, our Fund VII news

Plus the Forerunner Team's Must-Reads of the Week

The CQ is Forerunner’s weekly newsletter rounding up the most pressing consumer news and analysis, plus some bonus musings from our investment team. Subscribe now to get the latest edition in your inbox every weekend.

It’s been a week of news!

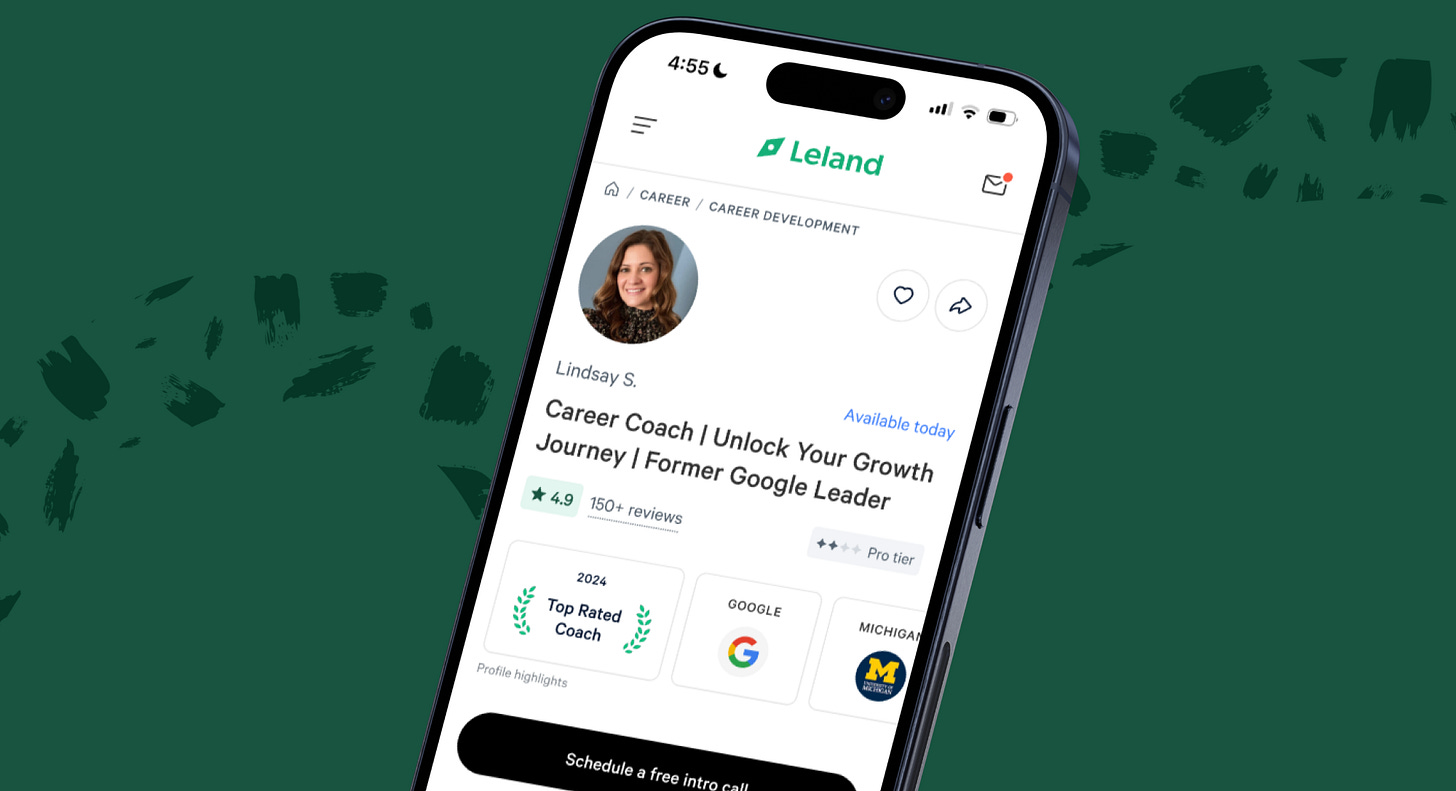

Leland announced their series A funding, a $12M round that we led with Eurie joining the board. This is a CEO and company we’d been courting for a while (~6 years, to be exact) and a space that we’d wanted to invest in for several years, but hadn’t yet found the right approach. The TL;DR on our investment: we believe a marketplace is uniquely the right model for scaling career coaching, so people can get to the next step professionally amid a time when it’s never felt so competitive. The opportunity for network effects, trust and transparency, and breadth and depth is off the charts, as proved by Leland’s early traction: 4x growth last year with 50k coaching sessions held on the platform in the last 12 months across 70 countries and 50 categories. For more, see TechCrunch and Eurie’s blog post.

Headway, the platform bridging the gaps between patients, providers, and health plans, hit its one millionth patient. As mental health becomes an increasingly acute crisis across the US, insurance-covered therapy is all the more essential. Headway CEO Andrew Adams’ blog post is well worth a read.

Wonder, the “fine casual” food concept rethinking food service and delivery, announced its acquisition of GrubHub. This ambitious team, helmed by Marc Lore, is firing on all cylinders and positioned for major scale ahead.

And finally, we at Forerunner announced our new fund! Fund VII is a $500M early-stage fund is dedicated to this time of imagination and development that will bridge what humans want with what AI will be able to do. Read Kirsten’s post on our optimism for this creative, messy stage ahead.

What We’re Talking About on Slack:

Fed cuts rates again, this time by a quarter point, bringing the federal-funds rate to a range between 4.5% and 4.75%. Following the previous Fed cuts in September, bond yields have unexpectedly spiked, leading to higher borrowing costs—the average 30-year mortgage rate has risen to 6.8% from 6.1%. While inflation has cooled, it remains above the Fed's 2% target, and there are concerns about the economy's future, particularly with the unknown of upcoming changes in government policies. According to Fed Chair Jerome Powell, officials are “trying to steer between the risk of moving too quickly and perhaps undermining our progress on inflation, or moving too slowly and allowing the labor market to weaken too much. We’re trying to be on a middle path.”

The global wellness industry is now worth $6.3 trillion—25% larger than it was in 2019, making it bigger than the sports and pharmaceutical industries. The surge in wellness spending is largely attributed to the pandemic, along with the rise of the aging population, chronic diseases, and focus on mental health. The industry’s largest sector is personal care and beauty ($1.21 trillion), followed by healthy eating, nutrition, and weight loss ($1.09 trillion), and physical activity ($1.06 trillion). The wellness real estate sector, which includes offices with smart air filtration and homes with wellness-focused amenities, is the fastest-growing with a value of $438.2 billion and an annual growth rate of 18.1%

Americans are feeling anxious—so they’re ‘doom spending’ as a way to cope with fears concerning the economy. This behavior is particularly common among younger generations who are largely relying on credit cards to fund impulse buys to get quick dopamine hits, causing a rise in credit card debt and delinquencies. “Gen Z and millennial consumers are also more likely to say it is better to treat themselves now rather than hold off for a future ‘that feels like it could change at any moment.’”

‘No social life, no plans, no savings’: The Guardian looks at how many Americans aren’t reaping the benefits of the booming U.S. economy. Retirees are facing challenges as low interest rates hurt their savings. Younger workers are struggling to get by. Even college-educated professionals with established, historically well-paying careers, such as architects, lawyers, engineers, and medics, are experiencing “high levels of hopelessness” about their financial stability. Many respondents pointed to rising homelessness and a growing divide between the rich and poor as signs that the economic recovery seems to benefit the wealthy while leaving others behind. “I’ll never own a home. A new car is unthinkable. The economy is slowly making the rich richer. Everyone else is sinking.”

WSJ: Has luxury lost its shine? Over the last two decades, luxury brands have expanded into lower-priced items like cosmetics and small handbags to attract a broader, middle-class audience and increase sales. But today the average luxury product is 60% more expensive than it was back in 2019, leading many consumers to question whether these goods are still worth the cost, especially since the quality has not improved to match the price hikes. Sales of the eight luxury brands that have reported their third-quarter results are down 4% on average from a year earlier, in particular Gucci which has seen a 25% decline. Social media has complicated things. “Social media makes it easier to see what others are wearing, but when part of what you are selling is scarcity, that can be challenging.” As a result, many companies are selling fewer items at much higher prices to minimize the risk of overexposure, which, in turn, alienates their less-wealthy customers.

The Cut delves into why nurses are going from the ER to the med spa. Driven by burnout from the high demands and emotional toll of hospital work, a growing number of nurse practitioners, registered nurses, and physician’s assistants are transitioning to the more lucrative, flexible, and low-stress medical aesthetics industry to deliver Botox and dermal filler injections at med spas with the promise of “no weekend work … and no gunshot wounds.” This trend brings to light the challenges and shortages in the nursing profession. According to a 2022 survey, 50.8% of nurses reported feeling emotionally drained, 49.7% fatigued, and 45.1% burned out. Subsequently, the number of students in entry-level BA nursing programs declined by 1.4% last year, 9.4% in master’s nursing programs, and 4.1% in Ph.D nursing programs.

Homebuyers are now the oldest and wealthiest in history. According to a new report from the National Association of Realtors, the average homebuyer is 56 years old, compared to 49 just last year. The median first-time buyer age also jumped to 38 from 35. To afford the increasing costs of homes, many buyers are now wealthier than before, with the median income of first-time buyers now at $97,000, an increase of $26,000 in two years. And 26% of homebuyers—an all-time high—are opting for all-cash payments to avoid high interest rates. The racial gap in homeownership has also grown, with 83% of buyers being white, while Black Americans continue to face declining homeownership rates, at just 7%. Additionally, families with children are finding it increasingly difficult to purchase homes, with 73% of recent buyers being child-free, the highest rate on record. In contrast, single women are becoming a larger segment of homebuyers, comprising 20% of buyers, compared to 8% of single men.

When chronic diseases come with chronic financial pressures: The New York Times takes a look at the ongoing costs of treatment for the estimated 129 million Americans who deal with a major chronic disease, like a heart condition or an autoimmune disease. Due to the high price of drugs like Stelara and Imbruvica costing over $13,000 and $15,000 per month, approximately 3 in 10 adults report skipping or adjusting doses of prescribed medications, often compromising their health. This is especially true for women and people with disabilities. “Struggling with a chronic disease can often hinder people’s ability to work. Not only do your expenses go up, but the income coming in may go down.”

Americans are drinking more, contrary to the rise is the rise in attention to sobriety and low-alchohol brands. New data shows 69.3% of adults reported steady alcohol consumption in 2022, up from 66.3% four years ago. More concerning is the increase in heavy drinking, which rose to 6.29% from 5.1%, with significant increases in adults in their 40s. Drinking habits worsened for all demographics except Native Americans and Asian Americans, and, notably, women reported a slightly higher rate of heavy drinking (6.45%) than men (6.12%).

The New York Times on how tech created a ‘recipe for loneliness’: “The consensus among scholars was clear: While there was little proof that tech directly made people lonely (plenty of socially connected, healthy people use lots of tech), there was a strong correlation between the two, meaning that those who reported feeling lonely might be using tech in unhealthy ways.” Researchers say the main behaviors fueling loneliness include texting (which limits authentic connections), binge-watching (which contributes to sedentary behavior, isolation, and sleep disruption), and comparing yourself to others online (which speaks for itself).

Portfolio Highlights:

Wonder’s acquisition of Grubhub is covered by Axios, CNN, NY Post, The Information, Reuters, TechCrunch, The Verge, and Wall Street Journal.

The Wall Street Journal discusses how Glossier’s marketing for its new perfume captured the Gen Z audience, with quotes from Emily Trillaud, Glossier’s vice president of product.

Business of Fashion features Daydream Co-founder Julie Bornstein and the first public demonstration of the AI shopping platform at BoF VOICES 2024.

TechCrunch profiles Pie founder Andy Dunn.

KiwiCo founder and CEO Sandra Oh Lin visits the Modern Retail podcast to talk about the brand’s retail expansion.

Oura CEO Tom Hale weighs in on the possibility of Apple launching a smart ring in a CNBC interview.

Narvar CEO Anisa Kumar speaks at WWD’s annual Apparel & Retail CEO Summit about embracing digital transformation.

Jobs of the Week:

Marketing Campaign Operations Lead at Headway, which is scaling in-network mental healthcare

There are ~645 other jobs currently available at portfolio companies, check ‘em out.