The CQ | Leading Monarch Money's Series B to Solve Money Management

Plus the Forerunner Team's Must-Reads of the Week

The CQ is Forerunner’s weekly newsletter rounding up the top consumer news, plus bonus musings from our investment team and portfolio highlights. Subscribe to get the latest each weekend.

Forerunner | @ForerunnerVC

Managing money is a forever problem and it affects everyone. Regardless of age, income, or life stage, most people still don’t have a place to go when it comes to getting a clear, complete picture of their financial lives. Money is often overwhelming, anxiety-inducing, and uncertain: no matter how much you earn, it never feels like enough, and rarely like you are truly in control.

There is no shortage of data on this: 88% of Americans experience financial stress, with 65% citing finances as their biggest source of stress. And a quarter of couples identify money as their greatest relationship challenge, with the average couple arguing weekly about money and financial problems accounting for one of the top reasons for divorce.

Despite this significance and pervasiveness, money management has proved an incredibly difficult problem to crack, with no real innovation in this space since Mint.com (launched nearly *two* decades ago). This market is uniquely well-suited to be revisited today with the tools we have available to us now, as AI excels at being proactive, intelligent, and actionable by default.

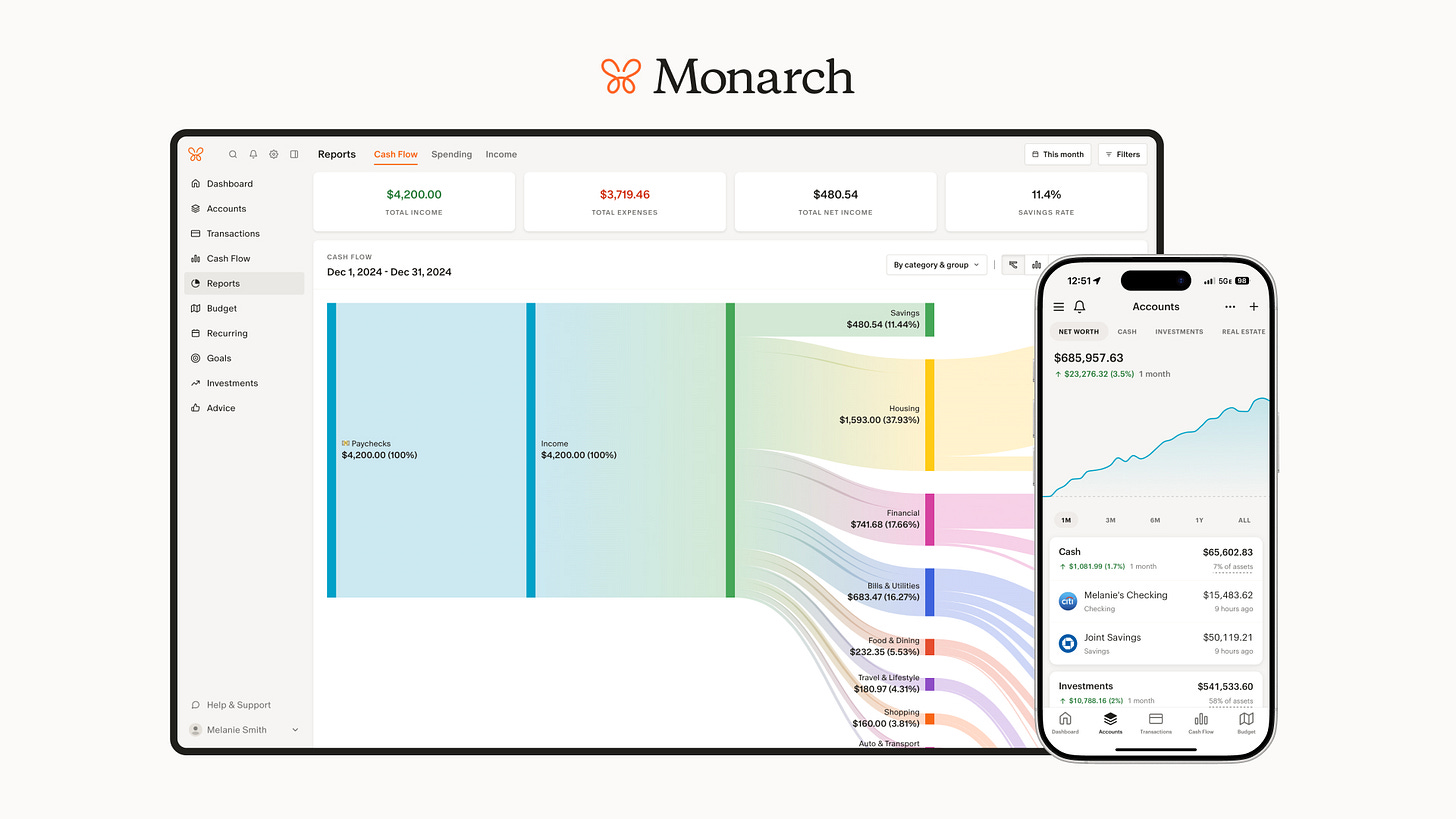

Enter Monarch Money, the modern, intelligent platform built for everyone from the beginner budgeter to the savvy personal wealth manager. Monarch offers a seamless, AI-powered view across a consumer’s entire financial world—spending, income, debt, and assets—helping people make smarter decisions, plan scenarios, and take confident action.

The approach is working: in 2024, Monarch grew 6x, making it the rising leader in it’s industry.

As early investors in OURA, a company that redefined how people think about sleep,

we see Monarch leading a parallel transformation in personal finance — pioneering a new approach grounded in transparency, education, and empowerment for better real-life impact.

For more on Monarch Money, see their story in CNBC and Eurie’s blog post.

What We’re Talking About on Slack:

To Gen Z, everything is a recession indicator. Recent memes and TikToks are posting signs of supposed "recession indicators"—from the return of recession-era flash mobs to Kesha and low-rise jeans. Granted, while many of these sound like overanalyzing, there are some real signals of reduced discretionary spending, such as rising prices on $1 pizza, “recession blondes” growing out their roots to stretch out salon visits, and the new partnership between DoorDash and Klarna for buy-now-pay-later food delivery. “People need a narrative. They need something they can understand. And if you’re an average person trying to understand the economy, you’re not going to use the yield curve.” Economists say cultural shifts are not reliable predictions, however widespread economic anxiety can become a self-fulfilling prophecy as more people begin to pull back on spending.

Consumers prop up the economy. They’re showing signs of strain. U.S. consumer spending, which accounts for over two-thirds of the economy, has slowed despite helping stave off a recession in recent years amid high inflation and interest rates. Savings built during the pandemic have largely been depleted, and delinquencies on credit card debt have risen steadily since 2023, with total loan delinquency reaching its highest level since 2020. Although unemployment remains low at around 4%, the labor market has cooled, with job openings declining and wage growth slowing, particularly for low-wage industries. Consumer spending is now outpacing income growth, a trend economists say is unsustainable unless wages rise, which appears unlikely given current job market conditions. Says the chief economist of Moody’s Analytics: “The economy is really vulnerable to anything that could go wrong, and clearly there’s a lot that could go wrong.”

“I’m a LinkedIn executive. I see the bottom rung of the career ladder breaking.” This New York Times opinion essay takes a look at how AI is reshaping entry-level jobs, particularly in sectors like tech, law, and customer service. In a recent LinkedIn survey, 63% of executives reported that AI will eventually take over tasks once assigned to junior employees. And although the World Economic Forum predicts that AI may eventually create up to 78 million new jobs globally, its short-term impact is slowly eliminating traditional career-launching roles, especially for professionals with more advanced degrees. As it is, the unemployment rate for recent college graduates has risen 30% since September 2022 in comparison to the 18% for all workers, and Gen Z has the lowest levels of career confidence among professionals. The wage loss from early-career unemployment can have lasting effects, with one study estimating a $22,000 income drop over a decade for those who face six months of joblessness at age 22.

Consumer sentiment darkens further with inflation worries rising. In May, U.S. consumer sentiment dropped for the fifth consecutive month from 52.2 in April to 50.8, the second-lowest level on record. The University of Michigan's survey showed sentiment is now down 30% since December, with nearly 75% of respondents spontaneously citing tariffs as a major concern, up from 60% the previous month. Consumers now expect prices to rise 7.3% over the next year compared to 6.5% in April. A separate index measuring future expectations fell to 46.5, its lowest point since 1980.

Digital creator jobs jump 7.5x since the pandemic. The number of full-time equivalent digital creator jobs in the U.S. surged from 200,000 in 2020 to 1.5 million in 2024, marking a 7.5-fold increase, according to a new report. Creators now represent the largest and fastest-growing segment of the 28.4 million internet-dependent jobs in the country. Creator media revenue is growing at 5x the rate of traditional media, and the internet-supported economy now accounts for 18% of U.S. GDP—up from 2% in 2008. Since 2020, creators have made up 30% of new digital economy jobs, while service platform workers like those on Uber and Airbnb account for 8%. Case and point for Stan, which enables anyone to make money working for themself.

Gen Z’s new side hustle: selling data. Young people, especially Gen Z, are significantly more open to sharing personal data than older generations, with 88% willing to share with social media companies, 20 percentage points higher than older adults. About 33% of Gen Z say they don’t mind being tracked by websites or apps, compared to 22% of older generations, and they are more likely to expect compensation for their data. Generation Lab's new product, Verb.AI, pays users $50 or more per month to install a tracker on their phone that collects anonymous data on browsing, purchases, and app usage. The company says this will improve accuracy over traditional surveys that ask respondents to self-report. Generation Lab's pitch deck says, "For decades, market research has been the equivalent of a doctor asking a patient to describe their symptoms. VERB is an MRI machine."

“The giants of Silicon Valley are having a midlife crisis over AI,” says WSJ. Tech companies, including Apple, Alphabet, Meta, and Tesla, are facing a turning point as AI threatens to disrupt their long-held dominance. Despite their combined market value of around $7 trillion, they are struggling to define clear strategies for integrating AI, while smaller, more agile startups may have opportunities to disrupt them. “Successful companies doing everything seemingly right can fail when smaller companies, not constrained by what has been, rise up, often with new technologies or processes. Think Netflix targeting through-the-mail subscribers versus Blockbuster’s in-store model.”

Walmart is preparing to welcome its new customer: the AI shopping agent. The retailer is preparing for a future when AI shopping agents, not humans, make purchasing decisions online. These autonomous bots could bypass traditional advertising and search tactics, forcing retailers to rethink how they present, price, and promote products. Walmart is developing its own agents while also planning for third-party bots like OpenAI’s Operator. This shift could change how retailers interact with customers: “The way a bot shops is fundamentally different from the way a human shops, meaning retailers should think carefully about the way they display products on their sites. For one, agents may be less likely to be attracted to images or visuals designed to elicit an emotional response.”

Portfolio Highlights:

Forbes reports on how Steven Bartlett joins Stan as a co-owner to help support the next wave of creators.

Business Insider reports that Wonder has eliminated all food delivery fees.

Inc. writes about how Arcade uses ChatGPT’s Image Generator to create personalized products, with quotes from Founder Mariam Naficy.

Bloomberg, The Information, and PYMNTS report that Chime has filed for IPO.

Bloomberg writes about AI-native startups that pride themselves on low headcounts, including Daydream, with quotes from Co-founder Dan Cary.

Glossy writes how AI agents like Daydream are changing the way consumers search for products online, with quotes from Co-founder Julie Bornstein.

Business Insider reports that Superpower has acquired Base, a startup that provides at-home blood and saliva tests to help people improve sleep and diet with personalized lifestyle recommendations.

Forerunner Highlights:

Join us in congratulating Kirsten Green on her 9th consecutive Forbes Midas List appearance.

Job of the Week:

Head of Finance at Topline Pro, the Shopify for home services professionals.

There are other open jobs at Forerunner portfolio companies — check ‘em out.