The CQ: Leading Craftwork’s Seed Round to Build the Beloved Consumer Brand in Home Services

Plus the Forerunner Team's Top Read of the Week

The CQ is Forerunner’s weekly newsletter rounding up the most pressing consumer news and analysis, plus some bonus musings from our investment team. Subscribe now to get the latest edition in your inbox every Saturday.

Meet Craftwork: a new company building the first iconic consumer brand in home services through a trusted, reliable, tech-enabled source for home repairs, starting with house painting — while also reshaping the SMB sector in this space to be more equitable and lucrative for its many hardworking craftspeople. In the words of Tim Griffin, Craftwork’s CEO: “We believe this is a rare opportunity to build something massive, not just to build a national brand in home services, but also to provide good paying, stable jobs and to erase the stigma associated with the trades and to give folks an opportunity for upward mobility.”

When we first learned of Craftwork, we were taken by the freakishly effective, scrappy team: Craftwork has quickly scaled to significant revenue growth in just a few months of operating in only one market, and it wasn’t the founders’ first rodeos — Tim took this last company from $1m to $150m in revenue in just 18 months.

Today, we pleased to share that we led the $6m seed round for Craftwork, joined by General Catalyst, Y Combinator, a16z General Partner Jeff Jordan and DoorDash Co-founder Evan Moore.

We could have made the investment solely on the basis of flawless execution and full-category ambition, but it helped that Craftwork sits squarely at the intersection of several themes we’re tracking closely at Forerunner:

Massive “real-world” industries where there’s meaningful opportunity for reinvention:

Home services is a $500B industry that’s hardly seen any change since it shifted from the Yellow Pages to marketplace aggregators in the 2000s. And today, consumers have no where to reliably turn when trying to do a home upgrade — pricing (and quality of service) are all over the map. Get three quotes online for a paint job; the spread and opacity of what you get back are mind boggling.

It’s easy to think that with all the tech advancements over the past 10-20 years, most opportunities for modernization have been claimed, but we still see plenty of space in big, unsexy industries that have been overlooked due to historical fragmentation or misconceptions. It’s this thesis that led us to invest in Fora, a company reinventing the composition of the travel agency, and Atticus, the largest public-interest legal services provider for consumers.

Digitally-Native Franchises:

While Craftwork has grown through an owned-and-operated model to date, there’s a big opportunity for scale through franchising where top quality, local home services businesses join Craftwork to modernize their operations, offer customers a sleek tech-enabled experience, and benefit from Craftwork’s brand halo that drives marketing and growth. Overall, we see Digitally-Native Franchises as a highly compelling new model for entrepreneurship, where local SMBs thrive as a part of a larger platform with proven playbooks, operational and marketing support, and significantly more opportunity for value accrual than going at it on their own.

Consumers’ reorientation towards core life foundations, focusing on stability and pragmatism:

The home services space is seeing unique tailwinds: after years of so much time at home through the pandemic, consumers have refreshed, dedicated passion for renovating their living spaces and living more quiet, settled lives — a trend that’s persisted even since things “returned to normal” (The Economist calls this the age of the hermit consumer). This is all part of a larger trend where we’re seeing consumers craving more simple, pure ways of living, investing in stronger core life fundamentals amid a time of so much social, political and economic upheaval. One might argue that a weakened macro would be a major drag on home services, but with mortgage rates untenable for so many would-be homebuyers, consumers are instead upgrading the spaces they have.

Read more on Craftwork’s seed funding in Forbes and be sure to keep an eye out for those Craftwork-branded vans (and jumpsuits) when they come to your market.

What We’re Talking About on Slack:

Millennials aren’t having kids. Both married and unmarried, gay and straight, Millennials are choosing to not to have kids — at least for now. A 2021 Pew Research poll found that about 56% of childless adults ages 18 to 49 said they just didn’t want kids, while 44$% said they were not too likely, or not at all likely, to have children (up from 37% in 2018). There’s speculation that the reasons may be due to the barrage of economic headwinds that Millennials have faced, or related to a sort of performance anxiety of not being able to achieve what their parents have. “We have a pretty strong set of prerequisites: You absolutely should finish school, and have a decent job, make a decent income, be in a good partnership, and live on your own. That takes a while to accomplish, especially in this day and age. Some people may feel like they’re never going to be in a good place.”

The New York Times asks: Is remote work the answer to women’s prayers, or a new ‘mommy track’? Even pre-pandemic, workers who took advantage of workplace flexibility tended to be seen as less serious. There’s the “proximity bias” of seeing coworkers in-person and the increased mentorship that goes along with it, automatically giving those in the office an advantage. According to one female legal scholar, “hybrid workplaces make it easier for women to remain in the labor force but harder for women to advance.” Bloomberg picks up the WFH conversation: “Some women indicate that if companies aren’t willing to redefine what the ideal worker looks like into something that jells with the reality of their lives, then they’ll just redefine success in a way that falls outside the bounds of corporate America. A growing number of women have started their own businesses and are leaving full-time jobs to become independent contractors.”

The life expectancy gap between American men and women is at its widest in nearly 30 years, says a new study that links the findings to more men dying from COVID-19, drug overdoses, homicide, and suicide. In 2021, women had a life expectancy of 79.3 years, while men’s was 73.5 years. Compare that to 2010 when the numbers were 78.1 for women and 76.3 years for men. “All of these [factors] point to a picture of worsening mental health across the board, particularly among men.”

Buying a house isn’t happening, so they’re spending and saving differently. With interest rates and housing prices sky high, Americans are postponing dreams of buying a new home and recalibrating their plans. Some are putting that money towards relatives’ futures — there was a 15% uptick in new 529 college savings accounts opened from a year ago. Some are using the funds on renovating their current home; there was 5.4% gain in home improvements and repairs over the previous period on top of a 17% gain the year before. Meanwhile others are splurging on expensive vacations. Perhaps owning a home may no longer be considered a goalpost of success: “We used to be able to work for a few years, save for a home and get our independence. That mental model is shifting.”

The low-wage pay surge is over, threatening the consumer boom. Due to labor shortages in the last few years, workers in lower-wage jobs, like leisure and hospitality, had the opportunity to obtain larger pay raises and perks, not to mention extra pandemic relief from the government. Now that there are more workers available, there’s been slower wage growth overall, but particularly at the lower end: This October, those workers received just a 5.9% raise as opposed to the 7.2% increase in January. “Retailers are noticing low-income consumers pull back, and economists expect this to cool an exceptionally strong streak of consumer spending, though they don’t see an outright bust.” While the finances of low-income households aren’t nearly as rosy, they aren’t going to backslide, according to The Wall Street Journal: “with inflation easing, wages have been rising faster than prices since mid-2023.”

The Target CEO says shoppers are pulling back, even on groceries. The retailer has seen seven consecutive quarters of declining sales on discretionary items, like apparel and toys, as well as fewer units sold in the food and beverage categories in the last few quarters. In turn, its plans for the holidays are more cautious, especially after past seasons that they missed the mark — not enough inventory during the pandemic, too much of the wrong merchandise last year. “We’ve taken a much more conservative approach in planning inventory this year. But we’re going to lean into those big seasonal moments and play to win, when we know the consumer is looking for something that’s new, looking for affordability, looking for that special item for the holiday season.”

The whole world is at risk for ‘compassion fatigue.’ Defined as “the emotional and physical exhaustion that sometimes afflicts people who are exposed to others’ trauma,” the concept has been primarily studied in people in healthcare and social work. But during these particularly trying times, says TIME, “just about everyone is near-constantly exposed to content about war, violence, death, and injustice on the news, internet, and social media.” Counselors are finding that more people are complaining that they can’t watch the news anymore and they’re experiencing symptoms similar to those associated with PTSD or emotional numbness.

The No. 1 industry Gen Z wants to work in — it’s not tech or finance. According to a new survey of 1,000+ Americans ages 16 to 25, the top industry is media and entertainment due to its flexibility and self-expression. A big part of the draw for many is to become a creator — 57% of Gen Z’ers said they would like to become an influencer if given the chance (it’s very possible they don’t know the realities of being a creator are quite taxing, with the average creator making ~$44k a year).

A quick snapshot of the state of the consumer + spending based on recent data:

Americans spent 5.8% more in August than a year earlier, and they spent 3.8% more this September compared to the last.

US retail sales rose in Sept for sixth-straight month at 0.7%.

Spend only started to cool in October — down 0.1%, the first drop since April.

But there’s still an e-commerce surge: consumer spent 76.8 billion online in October, a 5.9% YoY increase.

CPI was flat in October from the previous month but increased 3.2% from a year ago. Both were below estimates, sparking a rally on Wall Street.

Overall: incredible consumer resilience amid economic uncertainty, with some (welcome) signs of slowing in the face of curbing inflation.

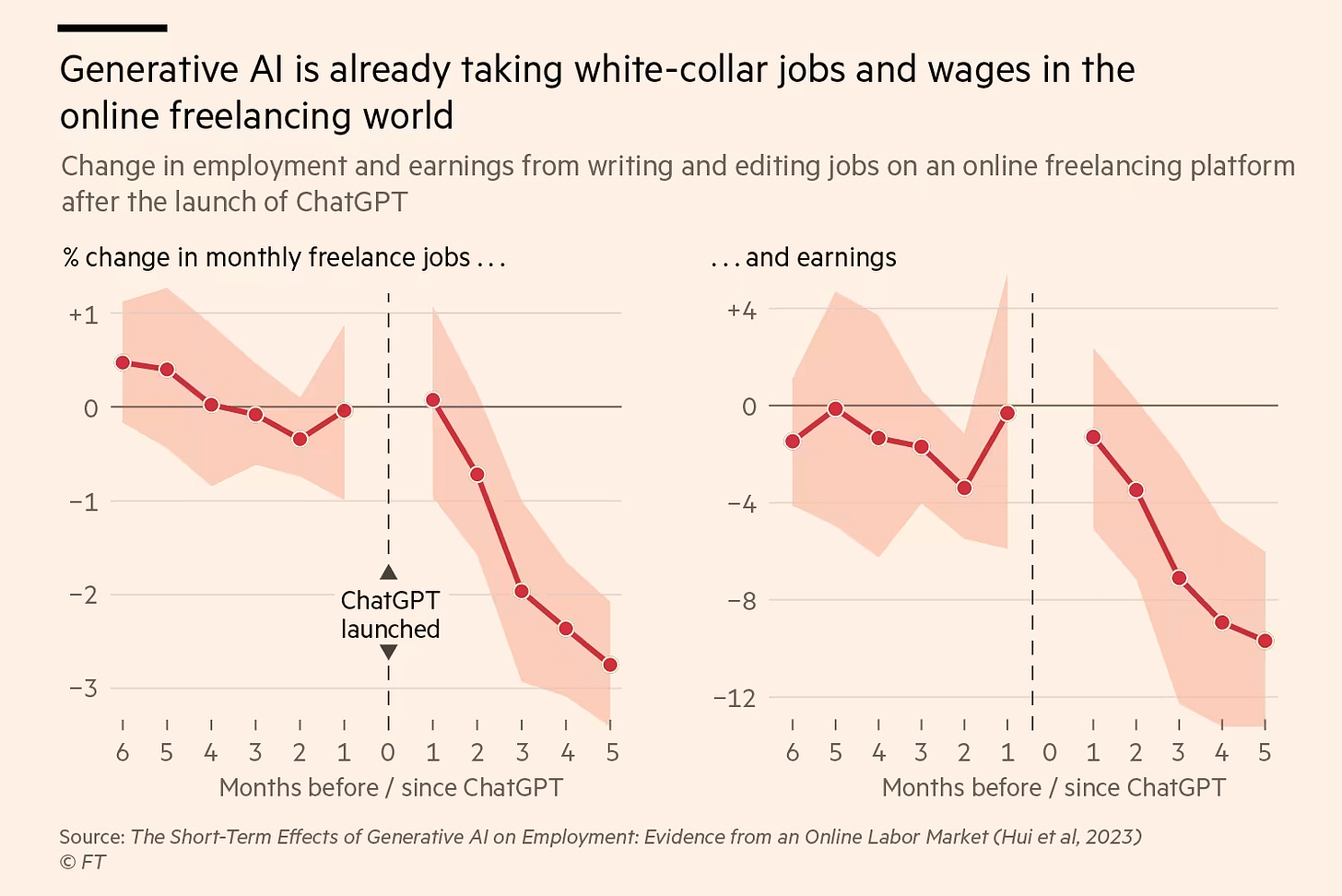

The Financial Times breaks down what we know so far about generative AI’s impact on white-collar work. A recent study found that within five months of the launch of ChatGPT, copywriters and graphic designers on major online freelancing platforms saw a significant drop (less than 3%) in the number of jobs they got saw a steep decline in earnings (over 8%), as researchers learned that being highly skilled did not offer protection from loss of work.

Portfolio Highlights:

Fortune reports that Wonder Group has closed its $103 million acquisition of Blue Apron with quotes from CEO Marc Lore.

Hims and Hers and co-founder and CEO Andrew Dudum, are featured in a New York Times story on the trend of teledermatology companies disrupting skin care.

Oura’s chief marketing officer Doug Sweeny shares with Ad Age how the brand is forging a new identity.

Ari Bloom, founder and CEO of A-Frame Brands, is quoted in Business of Fashion weighing in on what happened with underwear startup Parade.

Yahoo!Finance spotlights Arrived’s study on the five best up-and-coming places to buy rental properties.

Tally Health’s Biological Age Test is featured in MindBodyGreen’s gift guide.

Forerunner Highlights:

Managing Partner Eurie Kim joins The Twenty Minute VC podcast for a roundtable discussion on seed rounds, raising Series B and C, AI, crypto, consumer and more.

Work at a Portfolio Company:

Strategic Finance Lead, Global Topline | Faire: Faire is an online wholesale marketplace built on the belief that the future is local — independent retailers around the globe are doing more revenue than Walmart and Amazon combined. This role will own the analysis and synthesis of company-wide topline key performance indicators and financial metrics in addition to managing the forecast process architecture (i.e. how inputs across various teams and functions come together to form the foundation for our financial projections).

Senior Account Executive | Pavilion: Pavilion is a b2b marketplace that engages both public sector stakeholders (the “demand” or “buyer” side) and private businesses that sell goods and services to local governments (the “supply” side) to make public procurement — a $2 trillion a year industry that shapes the lives of all Americans —more efficient and productive. This role will help create the company's first revenue generation business, defining the scalable playbook to 100x our marketplace overall.

Customer Success Manager | Topline Pro: Topline Pro is building the essential tech stack for home service businesses, helping service pros (e.g., roofers, landscapers, painters) acquire direct business, get up and running within minutes using Gen AI, and get discovered, trusted, and booked repeatedly. This role will manage a portfolio of SMB customers and create and execute an account growth strategy to achieve customer goals.

There are ~541 other openings on our jobs site. Check ‘em out.