The CQ | How Much Happiness a Salary Can Buy, and The Lie About Sleep

Our Top Reads of the Week

The CQ is Forerunner’s weekly newsletter rounding up the most pressing consumer news and analysis, plus some bonus musings from our investment team. Subscribe now to get the latest edition in your inbox every weekend.

By Forerunner

Happy Saturday! This week we had our Founding Partner Kirsten Green on the Forbes Midas List for her 8th year in a row (for more on Kirsten’s unique path and frame of thinking, we recommend this interview, which has a bit or something for everyone) — and we had also Eurie Kim on the TechCrunch Equity podcast talking about the IPO market, the state of consumer, and everything in-between. Enjoy!

What We’re Talking About on Slack:

Etsy Has a Temu Problem. For years, Etsy has strayed from its original “homemade” and “craft” values in favor of “Amazon-ification,” resulting in a sharp increase in drop shipping and mass production. Regardless of this shift’s impact on Etsy’s “shopping with a soul” ethos, it seems to be an increasingly strained business opportunity. A September 2023 analysis found that nearly 30% of Temu’s top-selling women’s clothing items were also listed for sale on Etsy, and 19 of Temu’s top 25 jewelry items also appeared on Etsy — often at much higher prices.

Nearly half of Americans reject EVs, in a blow to the US’s climate agenda, which would require 56% of all new vehicle sales to be electric by 2032. In a new AP poll, 46% say they are not likely to purchase an electric vehicle, and just 13% say they or someone in their household owns or leases a gas-hybrid car, and 9% own or lease an EV. More than half of the younger people polled are somewhat open to the idea, vs. only 32% of those 45+ who say the same. Among the top concerns are range anxiety, price, and a lack of public charger infrastructure.

Meet the HIFIs: Their obsession with luxury will tank them. We know of DINKs and NIMBYs, but what about HIFIs—“high income, financially insecure”? This group, mostly made up of millennials and GenZers, “want to exude ‘old money’ or ‘quiet luxury’ but are struggling to keep up with their lifestyle creep.” These generations were responsible for a 22% uptick in luxury spending in 2022, and a study from last year found that young people tend to compare their wealth to their peers and don’t want to miss out on things that a friend or influencer has. Often, a good chunk of HIFIs’ income goes towards recreation and personal care, even though they struggle to pay for housing and food. Another report showed 36% of American millennials making $200,000 or more live paycheck to paycheck.

YOLO is dying. That could be bad news for the economy. Following the pandemic, Americans were splurging on everything from renovations to new TVs and sneakers. But it looks like the YOLO economy (“go ahead and spend on what you really want”) is winding down, thanks to high inflation, a tight job market, and things starting to return to normal post-Covid. That said, when people do splurge, concert and plane tickets are still holding strong.

Related, we’re back to bargains: Stretched consumers spark the return of “value wars.” There have been more signs, mostly anecdotal from dozens of top consumer business executives, that shoppers have become increasingly price sensitive and some retailers are responding by holding off on price increases or offering lower-priced offerings. “It comes as pandemic-era savings are increasingly depleted and nominal wage gains have receded from 2022 highs?

The ballad of Birkenstock: Bloomberg recounts how the 250-yr-old German orthopedic shoe company with Succession-level family drama transformed itself into a luxury behemoth. After a rocky IPO in 2023, Birkenstock finally had its best-ever day of trading on May 30, bringing the stock up 20%+ since the IPO.

How much happiness can your salary buy? Researchers can’t agree. For years, $75k — about $110k in today’s dollars — was thought to be the magic number, based on a 2010 study. But recent research shows that it’s more complicated than that. What the newer studies show is that people who make more money tend to be happier day-to-day and overall, but only up to a certain point. “As your income increases, each dollar makes less of a difference to your happiness. The effect of a raise on one’s happiness is more about the percentage change than the dollar amount. If your pay doubled from $50,000 to $100,000, it typically would need to double again to $200,000 to generate an equivalent happiness boost.”

The Wall Street Journal put five top AI chat agents to the test on useful, everyday skills to see how they stack up. Some did better than others depending on the topic, ranging from creative writing to current events, cooking, health, finance, and coding—among Open AI’s ChatGPT, Anthropic’s Claude, Microsoft’s Copilot, Google’s Gemini, and Perplexity, but the bot with the most wins was lesser-known Perplexity. Meanwhile ChatGPT, even with its recent GPT-4o update, came in second, and coming in last place was Copilot.

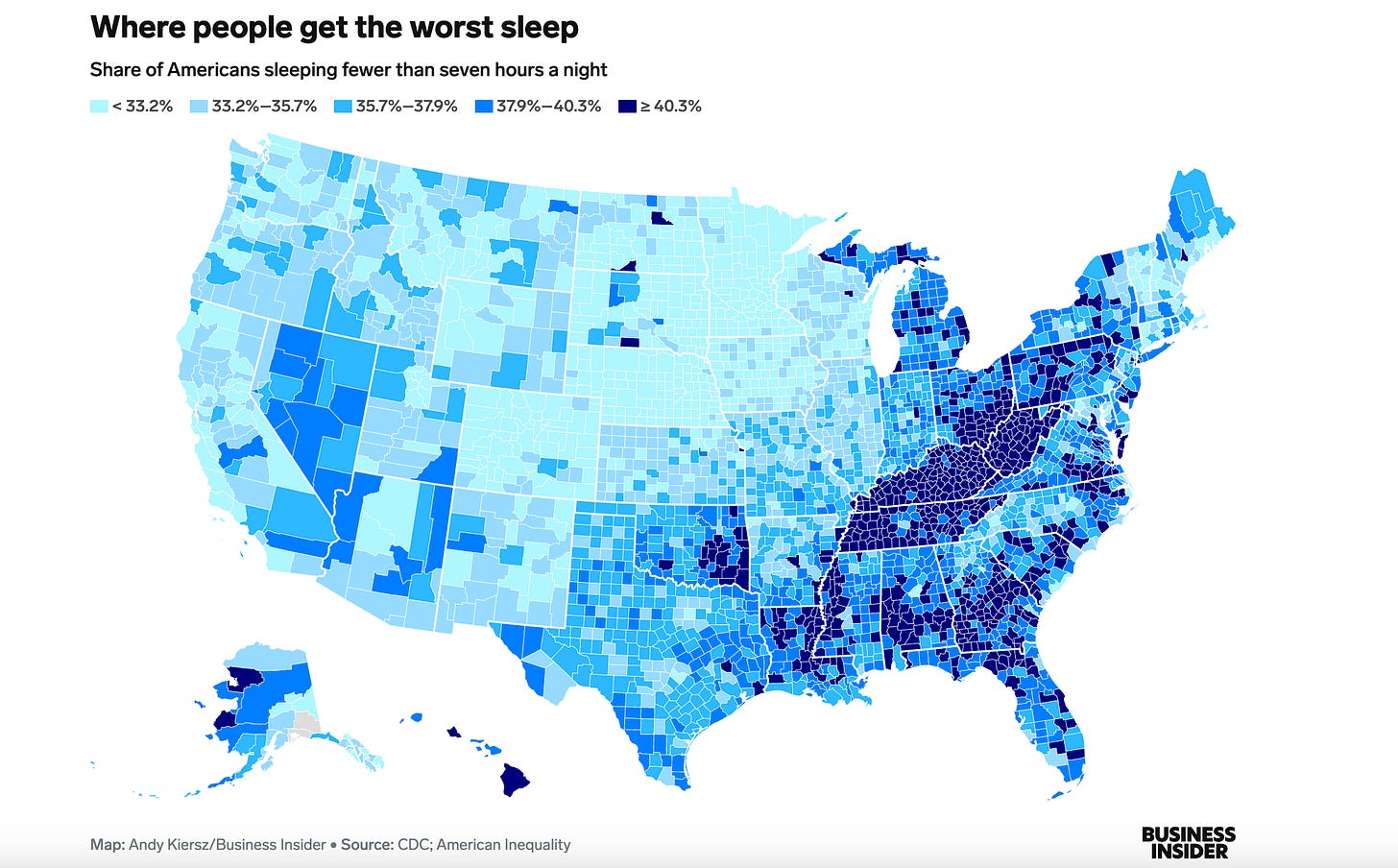

The lie about sleep: it’s mostly about your socioeconomic status. It was once thought that people who lived in cities with noise pollution and bright lights had the worst sleep. But CDC data shows that people who live in low-income, rural areas get the least amount of sleep, with residents in West Virginia, Kentucky, and Alabama at the top of the list. Stress, notably economic stress, is the leading cause of poor sleep. In those counties where nearly half the residents have poor sleep, unemployment rates are double the U.S. average and the median household income is about $35k. Mental and physical health issues also rate higher in low-income areas, and both those factors contribute to bad sleep. “Economic stress, depression, and physical pain make it harder to sleep, and the lack of sleep makes all these situations more difficult to manage.”

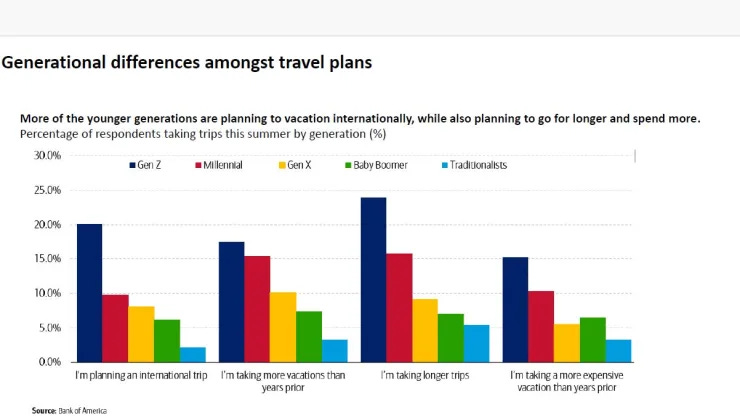

Gen Zer’s are traveling big this summer—and primarily taking on debt to make it happen. In contrast to 54% of Gen Xers and 40% of boomers, 65% of Gen Zs and 72% of millennials say they will spend on travel this year. However, 42% of Gen Zs and 47% of millennials are planning to use debt to cover the cost: 26% are relying on credit cards, 8% are opting for BNPL, 6% are borrowing from family and friends, and 5% are taking our personal loans. “Gen Zers have come of age during an incredibly turbulent time,” Roeschke said. “This is deeply impacting their travel behaviors.”

Portfolio Highlights:

Axios covers the partnership of Wonder with fresh meals producer Fresh Realm.

Forbes reports how Sunday revolutionized lawn care. Meanwhile, founder Coulter Lewis visited TechCrunch’s podcast Found.

Glossy and Retail TouchPoints announce that ShopShops will launch on TikTok Shop, where it will exclusively sell products from Century 21 NYC.

The Business of Fashion writes about Glossier’s expansion to Australia in partnership with MECCA Brands. Also, WWD covers the brand’s launch of nude lip liners.

There are ~580 jobs open at Forerunner portfolio companies, check them out.