The CQ is Forerunner’s weekly newsletter rounding up the most pressing consumer news and analysis, plus some bonus musings from our investment team. Subscribe now to get the latest edition in your inbox every Saturday.

By Jason Bornstein, Partner and Head of Research

Inflation is proving to be especially persistent, interest rates are remaining elevated for longer, and Americans’ savings accounts are shrinking. You’d think that might spell a more conservative spending environment. But in spite of all this - or perhaps because of it - the opposite is proving true.

Consumer spend is defying expectations and holding remarkably strong. Earlier this month, the government reported retail sales rose 4.0% year over year in March. The growth in retail spend is ahead of expectations and in spite of 3.7% inflation, a measurement that marks inflation’s first quarterly acceleration in a year.

In our inaugural Consumer Trend Report, we explored the products, services, and experiences that might have been categorized as discretionary in years past, but that consumers have come to expect and associate as common daily or weekly essentials. It’s a consumer behavioral shift where certain nice-to-haves have become need-to-haves.

This shift in expectations aligns with:

🤑 + 38% real consumer spend since 2007

🏦 + 50% median disposable increase since 2000

💳 + 64% credit card debt since 2003

💸 + 800% Affirm revenue since 2019 (BNPL proxy)

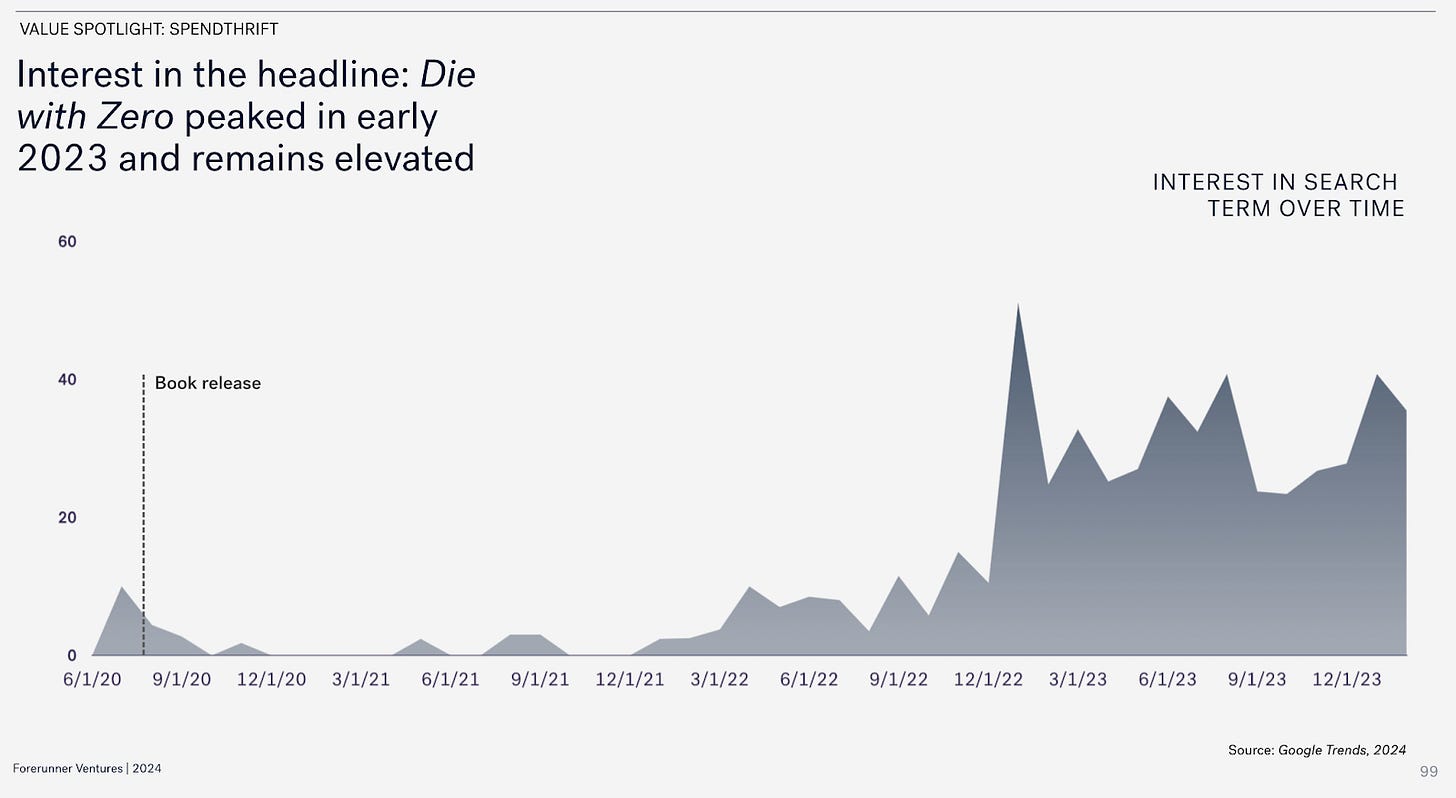

....as well as a growing pull toward the philosophies discussed in Bill Perkins' book, Die with Zero. Die with Zero, a spending and living ethos that’s the near-polar opposite of FIRE, has been surging in popularity since 2023 as consumers reprioritize their financial outlooks.

In Forerunner's recent reserch, half of consumers report "spending to live in the moment" and of those consumers over half switched away from "saving to retiring as early as possible" in the past few years.

In line with that…

55% of consumers have stopped saving for financial goals (primarily, buying a house or investing in education)

With over 40% unlocking dollars to live in the moment

With more dollars and a fresh approach, where are consumers prioritizing spend?

Shelter, health, education and food have expanded to include travel, fitness, gaming, coffee shops, delivery, beauty, coaching / therapy, ride sharing and more. A significant portion of respondents said these items are necessary:

🥕 34% grocery delivery (Instacart)

💳 33% credit cards w/ fees (American Express, JPMorgan Chase & Co.)

🥡 27% food delivery (DoorDash, Uber)

☕ 26% coffee shops (Starbucks)

For more on consumers’ openness to spending related to health, climate, and AI, check out our full report.

What We’re Talking About on Slack:

Despite doom-and-gloom news about young people’s high anxiety and predictions that they’ll never be able to buy a house, The Economist gives us reasons to be cheerful about Gen Z. What’s often left out of this narrative is that about 80% of 12- to 27-year olds around the world live in emerging economies and they are richer, healthier, and more educated than their parents. Still, even in the U.S., not only have young people shown to have bargaining power in the workplace, but Gen Z is unprecedentedly rich—they’re better off than millennials and boomers were at the same age. Hourly pay growth among 16- to 24-year-olds recently hit 13% year on year, compared with 6% for workers aged 25 to 54. The typical 25-year-old Gen Z’er has an annual household income of over $40,000, more than 50% above boomers at the same age.

TikTok isn’t going away—at least not yet. President Biden signed a bill into law that would require the social media platform to be sold within a year—and if not, it would be banned within the U.S. The Wall Street Journal breaks down what that would actually mean. If the ban were to go into effect, likely in 2025, (and ByteDance did not comply and disable the app), you’d be able to keep TikTok on your phone but you would no longer be able to download the app from app stores. It might be up to individual internet service providers to decide whether to restrict the app. However, the app wouldn’t be able to be updated and eventually it would stop working. (WSJ recommends downloading all of your data and videos and keeping your app updated so you have the latest version in the event of a ban.) It’s worth noting: TikTok’s growth has already stagnated, while YouTube Shorts has more than 70B daily views and people reshare Reels 3.5B times a day.

Home renovations are booming, thanks to high rates. Homeowners who don’t want to lose their low-rate mortgages are choosing instead to make the most of the house they’ve got. While renovation spending hit a record high in 2023, it’s still currently far above pre-pandemic levels. Topping the list of homeowners’ planned projects this year: interior painting (21%), garden/landscaping (19%), and a bathroom remodel (18%). Home services saw the largest growth of new businesses listed on Yelp in 2023—with, of all things, wallpapering services jumping 110% since 2022. This growth underscore the opportunity for companies like Craftwork and Topline Pro.

Meta is putting AI front and center in its apps, and some users are annoyed. Instead of the usual search results when users click the search button on Instagram, Facebook, and WhatsApp, now an AI assistant will appear to answer inquiries, except it’s mostly leading to confusion and frustration among users. “I think it’s trying to find a solution to something that wasn’t a problem. If I go on Instagram for banana bread recipes, I’m looking for a Reel, not a wall of text that may be a collection of data from different recipes.”

Gen Z shoppers want things, not experiences. A new survey of more than 3,500 Americans finds that Gen Z’ers are the only generation who would rather make a big retail purchase (2.8%) instead of paying for an upcoming event or show (0.4%). The only exception is travel: 3.7% of Gen Z would prefer to plan a trip. At the top of the list of financial goals for Gen Z is repaying a debt at 15.2% and buying a house at 15.1%.

TikTok has changed America, with 170 million Americans—half the population—using it. The New York Times put together an interactive package illustrating the impact the platform has had on culture and our daily lives, from what we watch, wear, and cook to how we diagnose ourselves and what we believe. One interesting tidbit from the piece, which often references TikTok’s on-point, personalized algorithm: “Some experts have proposed that [TikTok] can send users into a ‘flow state’: the experience of being so absorbed in a task that the person loses track of time. Backing this up, one study found that TikTok users reported experiencing higher levels of flow than Instagram users.”

It’s the end of the web as we know it, predicts The Atlantic. For one, there’s the potential that SEO will simply transform into LLM optimization, leading to AI-generated content that’s scammy or manipulated to serve certain agendas. Then there’s the real possibility of writers, artists, and other creators losing a connection to their audiences as well as compensation for their work. “Eventually, people may stop writing, stop filming, stop composing—at least for the public web. People will still create, but for small, select audiences, walled-off from the content-hoovering AIs. The great public commons of the web will be gone.”

Are family and faith staging a comeback? Amid a rise in deaths of despair, declining rates of happiness, and record-low birth rates, The Wall Street Journal argues that there is a growing body of research that suggests that there may be a correlation between religion and health and well-being, including that attending weekly religious service is associated with lower rates of depression and mortality risk. The article points to the trend of religion, marriage, and family life gaining more acceptance in books, media, and pop culture (including Taylor Swift and Hallmark movies).

Vox explores why couples are choosing cohabitation over marriage. According to the data: Of the Americans 18 to 44 who married between 2015 and 2019, 76% had lived together first. Between 1965 and 1974, that was the case for only 11% of couples. “Today’s couples may be no less committed than in decades past, but shifts in social mores have redefined the place of marriage in society — and set new standards for when a person feels ‘ready’ to wed.”

The New York Times poses the question: Aging in place, or stuck in place? Though nearly 80% of older adults live in houses they own, the idea of using a home with a paid-off mortgage to fund retirement is not as viable of a plan as it used to be. First of all, seniors looking to downsize have less options for affordable, one-floor homes on the market. Then the number of older adults with mortgage debt has been increasing since the 1980s, and the amount owed has risen too—43% of older homeowners with mortgages are considered “cost burdened,” meaning they’re spending 30% or more of their income on housing and related costs.

Portfolio Highlights:

Congrats to the Webby Award winners, nominees, and honorees: Oura is a winner for Apps & Software, Connected Products & Wearables; WNBA x Glossier Stretch Foundation is a winner for Social, Fashion, Beauty & Retail Campaign; Homebase is a nominee for Apps & Software, HR & Employee Experience; and Ritual is an honoree for Social, Health & Wellness.

Oura’s launch at Target is covered by TechCrunch and ModernRetail. Also, Oura CMO Doug Sweeney visited the Terra podcast to discuss marketing and the brand’s growth.

WWD profiled Ritual founder and CEO Katerina Schneider.

Prose co-founder and CEO Arnaud Plas joined the ModernRetail podcast to talk about paths to next levels of growth for the brand.

Glossier CEO Kyle Leahy discussed the brand’s impact in the competitive beauty market on the TD Cowan Insights podcast.

Architectural Digest interviewed interior designer and The Expert co-founder Jake Arnold.